What Is The First Component Of Kyc

The idea of money laundering is very important to be understood for those working within the monetary sector. It is a course of by which dirty cash is transformed into clear cash. The sources of the money in precise are legal and the money is invested in a means that makes it look like clear money and conceal the identification of the criminal a part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the new clients or sustaining existing customers the duty of adopting ample measures lie on each one who is part of the organization. The identification of such ingredient at first is straightforward to deal with instead realizing and encountering such conditions in a while within the transaction stage. The central bank in any country provides full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient security to the banks to deter such situations.

At the minimum the CIP requires the following information before any individual can open a financial account. August 2 Interfax - The preliminary results of a current study of combinations of the first component of the coronavirus vaccine Sputnik V with the AstraZeneca and Sinopharm vaccines in Argentina have shown no serious side-effects the Russian Direct Investment Fund RDIF said.

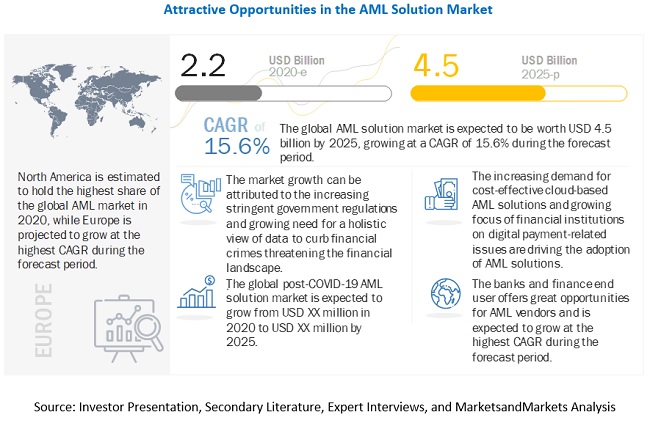

Anti Money Laundering Market Size Share And Global Market Forecast To 2025 Marketsandmarkets

The first component mobile connectivity has served as the bedrock for much of the fintech revolution creating digital financial ecosystems in developing countries.

What is the first component of kyc. Establish maintain and enforce written policies and procedures reasonably designed to address conflicts of interest. Through this launchpad the next-generation of disruptive Cardano applications can undertake significant capital raises through OccamRazers IDO capabilities. Certified articles of incorporation.

As per the guidelines of RBI Reserve Bank Of India all customer of any wallet or bank who want to use for higher balance Limit will increases for sending money or for another purpose. These modern financial tools have gained popularity among both new age investors as well as seasoned investors because they are ideal for investment planning. KYC regulations has often made it impossible for the marginalized to participate in the financial system and analog ID systems are inefficient and vulnerable to corruption.

In short KYC put requirements on financial institutions to stop illicit activity by knowing who their customers were part of the Customer Identification Program CIP and what they do as part of the Customer Due Diligence CDD. This guidance will bring some major changes in the regulations for these sectors. To comply with the first component CIP a bank typically asks the customer for scores of identifying information.

The first component of KYC is the Customer Identification Program or CIP which entails obtaining identifying information on a companys founders and leadership team. Date of birth 3. KYC stands for Know Your Customer.

KYC includes three components. What is Bitcoin KYC. It is safe to provide these details.

Regtech and Fintech will absorb major impact as this sector produces AML and KYC screening solutions DIgital ID systems. Identity proofing and enrollment is the first component and it involves the collection and verification of customer data. The service providers will have to make sure that their.

Hence it is mandatory to update the records of a customer from time to time. Further these components should be given appropriate risk grading along with. Mutual funds are considered to be way better than traditional investment tools as they hold the potential.

The second component is the affirmative anti-money laundering compliance program requirements of the Bank Secrecy Act as amended by the USA PATRIOT Act. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Certified articles of incorporation.

The main purpose here it to discourage money laundering. Establish maintain and enforce written policies and procedures reasonably designed to achieve compliance with Regulation Best Interest. The first component of Risk management is risk identification where we need to identify different risk factors that are present within the bank along with its respective components.

The first component should already be a part of a broker-dealers existing AML program so firms will need to focus on the other three components. Mutual fund investments are in trend these days. Components of KYC Coming to KYC Know Your Customer it has mainly two components.

The first component is the collection and verification of the customers. The second item requires firms to identify the beneficial owners of an account upon opening usually those with a 25 or larger equity stake except when certain exclusions apply. The first component of KYC is the Customer Identification Program or CIP which entails obtaining identifying information on a companys founders and leadership team.

The first component is the. Make sure you adhere to your countrys KYC norms and integrate a suitable customer verification procedure into your exchange. Conflict of Interest Obligation.

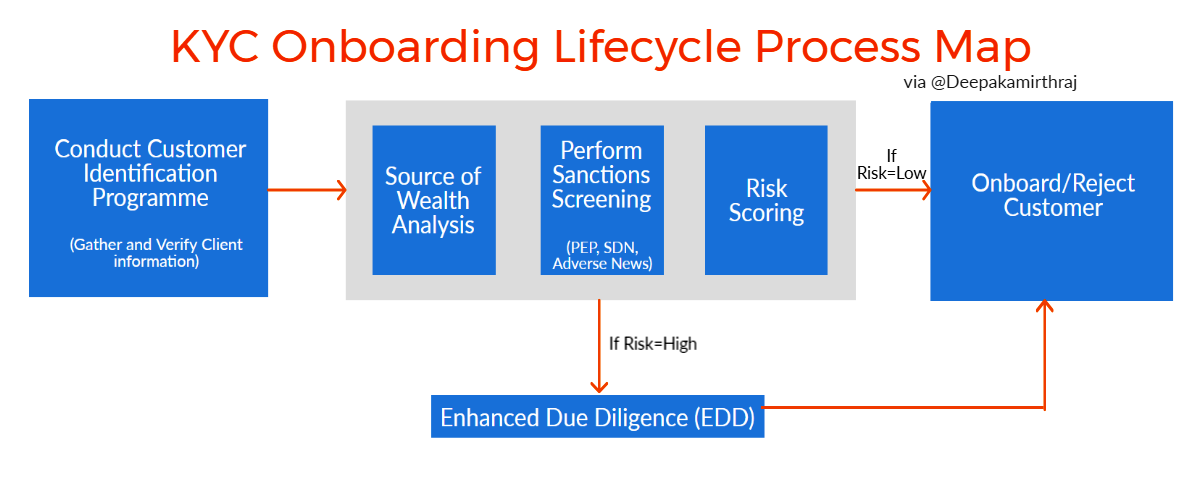

The first component of Occamfis ecosystem is its decentralised funding platform or launchpad called OccamRazer. A picture is shown on the 13th page of the guidance draft and it shows the process of collection of data from the official identity document like ID card and then screening of the information to verify the identity of a customer. Verifying the identity of the customer through a Customer Identification Program CIP Understanding the nature of the customers transactions Performing AML screening due diligence The first component identity verification entails having the customer.

The customer address may be changed depending on the city in which heshe is living. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. It is same as long as the account available in the bank.

KYC is the process whereby a business verifies the identity of its customers through government issued ID cards or passports. The CIP is the first component of the KYC process that helps ascertain the identity of an individual attempting to make financial transactions ensuring that it is safe to do business with this person.

Kyc Verification Process 3 Steps To Know Your Customer Compliance

Https Ec Europa Eu Info Sites Default Files Business Economy Euro Banking And Finance Documents Assessing Portable Kyc Cdd Solutions In The Banking Sector December2019 En Pdf

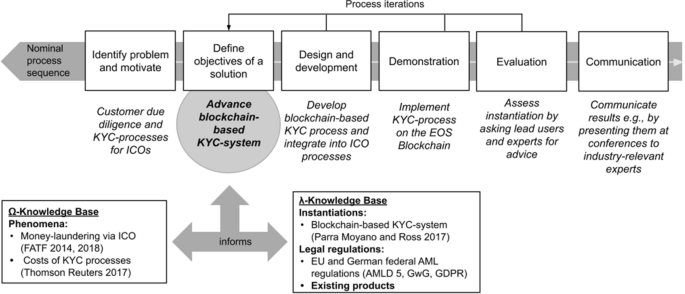

Know Your Customer Kyc Requirements For Initial Coin Offerings Springerlink

How Has Kyc Compliance Evolved Over The Past 5 Years 20 Experts Share Their Insights

Kyc Verification Process 3 Steps To Know Your Customer Compliance

Know Your Customer Kyc Process Guide For Banking Bpi The Destination For Everything Process Related

Know Your Customer Kyc Due Diligence Best Practices

Kyc And Edd Riskpro Management Consulting P Ltd

The Complete Guide To Understand Know Your Customer Kyc By Deepak Amirtha Raj Medium

3 Key Elements Of Kyc Compliance 2020

Knowing Your Customer How Blockchain Will Change The Kyc World

The world of regulations can seem like a bowl of alphabet soup at times. US money laundering regulations aren't any exception. Now we have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting firm targeted on defending monetary providers by lowering risk, fraud and losses. Now we have big financial institution expertise in operational and regulatory danger. We've got a strong background in program management, regulatory and operational threat in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many adverse penalties to the organization due to the dangers it presents. It will increase the probability of major risks and the opportunity cost of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment